The law and finance building plays a pivotal role in fostering financial success for individuals, businesses, and society at large. By integrating legal expertise with financial knowledge, this unique synergy creates a solid foundation for economic growth and stability. In this article, we will explore the various ways in which the law and finance building contributes to financial success. From regulatory frameworks and risk management to dispute resolution and ethical standards, the collaboration between law and finance ensures that businesses operate in a transparent and accountable manner, fostering investor confidence and attracting capital. Let’s delve into the key aspects where the law and finance building plays a critical role in bolstering financial success.

Table of Contents

Regulatory Frameworks and Compliance

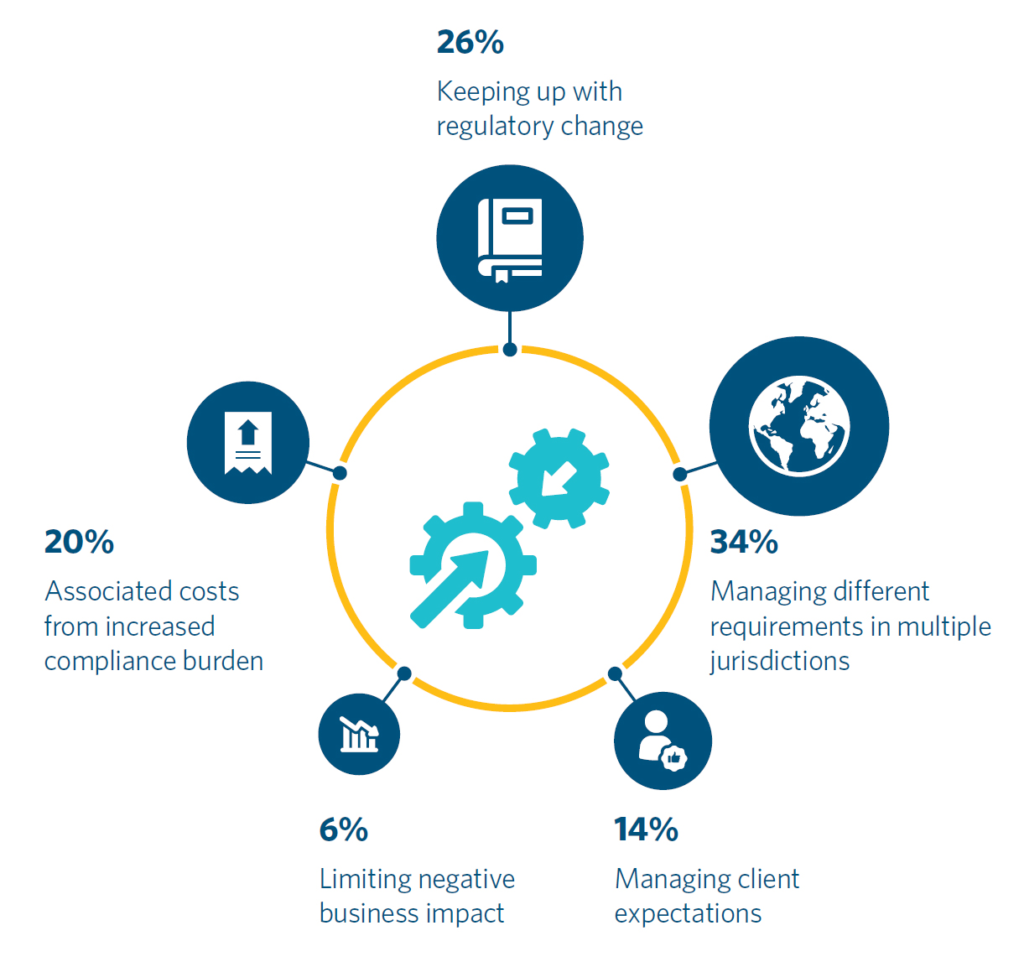

The law and finance building establishes regulatory frameworks that guide the operations of financial institutions and markets. These frameworks provide a set of rules and standards to ensure fair and efficient financial transactions. By enforcing compliance with regulations, such as reporting requirements and consumer protection laws, the law and finance building enhances market integrity and reduces the likelihood of fraudulent activities. Moreover, these frameworks facilitate the development of a level playing field, allowing businesses to compete fairly and promote healthy market competition. The law and finance building, through regulatory frameworks and compliance measures, establishes a stable and trustworthy financial environment that attracts investments and supports economic growth.

Risk Management and Mitigation

An integral part of the law and finance building is risk management, which helps identify, assess, and mitigate potential risks faced by financial institutions and investors. By implementing robust risk management practices, such as risk assessment methodologies and stress testing, the law and finance building enhances the resilience of the financial system.

This, in turn, instills confidence in investors and allows businesses to make informed decisions regarding investment strategies. The law and finance building also plays a crucial role in developing risk mitigation strategies, such as insurance mechanisms and derivatives markets, which help transfer and manage risks effectively. By prioritizing risk management, the law and finance building fosters financial success by reducing the impact of adverse events and ensuring the sustainability of businesses.

Dispute Resolution and Legal Remedies

Inevitably, disputes and conflicts arise in the financial realm, and the law and finance building provides mechanisms for their resolution. Through courts, arbitration, and alternative dispute resolution methods, such as mediation, the law and finance building offers a platform for fair and impartial resolution of financial disputes. This timely and effective resolution of conflicts not only saves resources but also safeguards the interests of all parties involved. By providing legal remedies, the law and finance building ensures that contractual obligations are enforced and that justice is served. This fosters trust and confidence in financial transactions, creating a conducive environment for financial success.

Ethical Standards and Corporate Governance

Ethics and corporate governance form the bedrock of the law and finance building. Upholding ethical standards is crucial in establishing trust between financial institutions, investors, and other stakeholders. By implementing strong corporate governance practices, such as transparency, accountability, and responsible decision-making, the law and finance building promotes sustainable and ethical business conduct.

Adhering to ethical principles not only mitigates risks but also enhances the reputation and credibility of financial institutions. Additionally, the law and finance building plays a key role in regulating conflicts of interest, insider trading, and market manipulation, ensuring fairness and integrity in financial transactions. By upholding ethical standards and promoting good corporate governance, the law and finance building paves the way for long-term financial success.

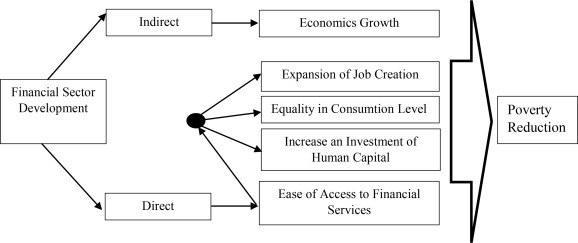

Access to Financial Services and Inclusive Growth

The law and finance building aims to ensure that financial services are accessible to all segments of society, fostering inclusive growth and reducing inequality. Through regulations and policies, the law and finance-building promotes financial inclusion, enabling individuals and businesses to access essential financial products and services. This includes initiatives such as microfinance, affordable credit, and financial literacy programs. By expanding access to financial services, the law-and finance building empowers individuals to participate in economic activities, invest in their future, and improve their financial well-being. In turn, this drives economic growth and creates a more equitable society, where everyone has the opportunity to thrive financially.

Conclusion

In conclusion, the law and finance building serves as a cornerstone for financial success. Through regulatory frameworks, risk management, dispute resolution mechanisms, ethical standards, and inclusive policies, this collaboration between law and finance establishes a robust financial ecosystem. By fostering transparency, accountability, and fairness, the law and-finance building attracts investments, encourages responsible business conduct, and ensures the stability of financial markets.

It plays a vital role in mitigating risks, resolving disputes, and upholding ethical standards, thereby creating an environment conducive to financial success for individuals, businesses, and society as a whole. Understanding the significance of the law and finance building is essential for navigating the complexities of the financial world and harnessing its potential for growth and prosperity.

Learn about: Transform your life with Gainesville Health and Fitness: Empower yourself and reach new heights of wellness and vitality.